Let's go

Baltic Tech Weekly #251

Brand and philomaths.tech built with achoo studio

Follow on Instagram, X, LinkedIn - we will follow you, too

happy to hear from you - editor@philomaths.tech

Brand and philomaths.tech built with achoo studio

Follow on Instagram, X, LinkedIn - we will follow you, too

happy to hear from you - editor@philomaths.tech

Happy New Year friends! Let's make it better in 2026. Wishing you only "thick desires" for 2026, as explained in one of the texts below (a thick desire is one that changes you in the process of pursuing it, a thin desire is one that doesn't).

Thanks for taking being part of this wonderful community!

9 themes for 2025

This game keeps on giving, and philomaths are excited

- The scaleups and unicorns accelerate. Yes indeed, some of the largest tech companies in the Baltics grow faster than some little startup (despite that vc round). Impressive traction by the likes of Hostinger (2nd fastest company for the whole decade across Europe), Vinted (10B GMV and beyond 1B revenue in '25, expecting their valuation to pass Bolt, soon), Nord Security (Tesonet group above 1B revenues in 2024 already, growing aggressive organically (Nord VPN, Surfshark, Oxylabs, Mediatech) + new ventures (nexos.ai) and acquisitions across the group). There is more to the club, for example Cast AI had two round announcements in 2025 (Ser C and more), Burga passed $100M YTD revenue before December, Orbio added 50 or more people to the team, likely revenue grew well beyond EUR 153M of 2024.

- Repeat builders. That's the best gift successful founders can give to the ecosystem is build next ventures, and invest into new startups. For LT alone, we pulled a list of 70 repeat founders building again, at least a second startup (some have done many more). It's revealing to see that for the founders of Surfshark, Ovoko, Eneba, Ace Waves, CyberUpgrade, InSoil, Sintra, Rizon, or others – it's not their first shot on the goal, and your latest company don't need to be your last try, too.

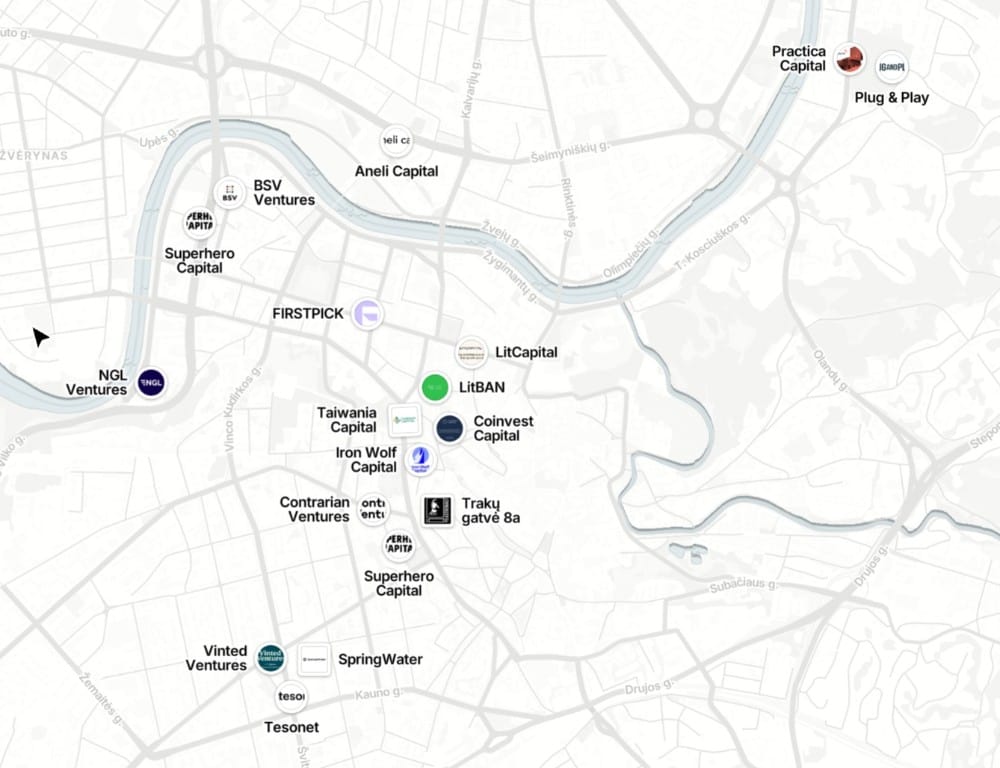

- More investors, going places. Beyond the local venture scene, emergence of local funds and vehicles to pursue broader strategies. Contrarian Ventures started early as true pan-European VC, this year Vinted Ventures (focused on Series A, B, and C in recommerce) and SpringWater (founder-backed SaaS acquirer, targeting 1M-10M ARR products), as well as Lost Astronaut (venture builder and investor, building European network with BaseJump Arena). Lots of regional action too – BSV Ventures adding Nordic / European portcos, Superhero Capital connects Finland and the Baltics, Practica Capital and FIRSTPICK very active across the Baltics, and more.

- Spread of the startup method. Forget days when startup was = B2B software or an app. Startup is definition is going broader, as globally scalable, fast growing firm with tech-enabled product. The ambition and scale is the connecting tissue. Tech ecosystem now embraces variety of products, such as semi-permeable capsules for high-throughput single-cell omics (Atrandi Biosciences), nootropic drink for mental performance (Brite), medical wearable for menstrual pain (Samphire), imaging systems for FPV drones (Luna Robotics), application-optimized dielectric thin film coatings (Optoman) – and many others.

- Places for doers, and time for young, raw talent. Resurgence of building and hacking communities followed AI boom – suddenly, you can easily build products on your own or with a small team, iterate with highest velocity, and benefit from like-minded community for accountabily and staying up to speed with latest tech. In 2025, action was all there at _basedspace (VNO), ruum (TLL), Shipyard AI (RIX). Hugely impactful, and all new founders / builders need to check these communities. This goes along with expanding community of young founders, supported now by various initiatives - like MVP, Jaunaragiai, Lost Astronaut, _buildspace program and others. There is a ton of energy and capability among new talents, and would love to see them mixing into existing companies and startups so that they can get ideas about meaningful problems to solve, and interesting products to build.

- Unpredicatable - new growth engines. We can spend endless nights scrapping data, linkedin updates and Unicorns' database – and still get surprised by new breakthrough ventures and exits. One of those has been Jurgis Pasukonis, as General Agents got acquired by Jeff Bezos' AI startup. Pulsetto broke the stats in 2025, too. We been also seeing Mantas, landing $2M pre-seed in Australia for Cor, Kasparas, successfully exiting Loctax, Justas, launching Monopulse from Denmark, and Rokas hiring in Switzerland. Similar with bootstrapped ventures, as we've been surprised by growth of Vladas' ventures (Eldorado.gg & Humbility.io), Tadas and Pickitoo, IPXO, Altechna, our supporters – Vialet, and many others.

- Level of ambition is going next level (and that's something we can't get enough of). We want most talented people to go after largest problems, which in turn become huge markets. Some of that ambition shows in the list of the largest Baltic fundraising rounds 2025. It includes Aerones (robotic wind turbine care), Atrandi Biosciences (technology for single-cell analysis), Pactum (autonomous negotiations), Starship Technologies (robotic delivery). What I would like to see more in 2026: YC style startup teams going after huge categories, as so much needs to be rebuilt (think AI-native CRMs, HR systems, ERPs, analytics and BI tools, finance stack – you name it).

- Impact. From supporting Ukraine, to improving education, to sports — successful tech founders are not retiring (yet) at French Riviera, and instead choose to put their knowledge, network and capital for good. List is long: various foundations, new NGOs and platforms, supporting art and culture, and more.

- Can't get enough – of founders. The bottleneck is clear, as discussed in Tallinn and confirmed by Unicorn Lithuania study. We need many more founders, to unlock true economic impact (jobs, taxes, income) to try building scalable venture. Strangely enough, despite AI enabling building products, we still seem to have declining rate of new teams coming together to build a tech-first business (page 27). Fundraising data is also telling (27 teams announced pre-seed / seed investment in LT 2025), although we can assume 20-30% of early stage rounds don't get announced immediately (for example, 12 more Coinvest Capital deals from last year are yet to be released, they have been actively deploying capital).

sponsors

Cloudvisor [AWS partner dedicated to startups]

Hostinger [online presence accessible to everyone worldwide, hiring]

Google For Startups [cloud credits up to $350K, expert support & faster growth]

Oxylabs [Step into the world of web data gathering]

VIALET [Business accounts for growth, hiring]

Ace Waves [Enterprise ready AI agents for CS, hiring]

Surfshark [Top 50 among fastest growing in EU, hiring]

15MIN Group [all the news you need to know]

- People moves – look, many people like to start the year fresh (see jobs below). Grazvydas leaving CMO+CSO position at NFQ. Marius joining Kaching Appz as Senior Product Designer. Justinas joins Ace Waves as Agent Product Manager. Ieva Dirvonskaite joined Copla as Head of Ops. Jonas Dikmonas steps down – he was co-founder and CEO of LastMile, now working on smth new. Ramil is now Head of Global Defence Tenders at Lendurai. Lilija joins Surfshark as Product Manager. Agne moves from Bored Panda to Eldorado.gg, as Chief HR Officer. Raiko is closing Simpleda project. Raimundas returning to Furniture1 as Brand Manager. Jaunius is now CBDO at Orbio World. Arnas is now Public Policy Lead, Baltics, at Google. Vytautas leaves Deeper to join Fellow. Ieva (former CEO and investor in The Knotty Ones) is returning to writing.

- TechChill goes to Vilnius on January 8th – meet them at Sparta Bar, incl Q&A with Rolands Mesters (BirdyChat, ex GoCardless).

rounds and capital

- 28 Lithuanian startups, that announced funding in 2025

- Superhero Capital wraps final capital raise at EUR 40 million. 13 portfolio companies and 1 in final contracting phase, to add 8 more or so in 2026. Also – hiring Investor Relationship & Communication Associate.

- Lukas' Mokafund had a busy year, deploying a lot alongside NGL.

- Busy year for Contrarian Ventures, Coinvest Capital, Practica Capital. Lost Astronaut is also just writing checks, all day long.

roleplay

Cloudvisor - Outbound Sales + Mid DevOps Engineer

Ace Waves - Senior Software Engineer + Senior Product Engineer

Hostinger - Global PR Lead + 80 other

Surfshark - 29 positions now, many engineering roles

Google - Field Sales Representative, Enterprise, Google Cloud

Oxylabs - Engineering Manager (new product) + everything else

VIALET - KAM, Engineers, more

Mediatech - product, tech, marketing - a lot of opportunities

FirstPromoter - SEO and Growth Marketer

CoinGate - BDR and more

Ergonix - Ecommerce Specialist

Optoman - KAM

isLucid - Developers

Ace Waves - Senior Software Engineer + Senior Product Engineer

Hostinger - Global PR Lead + 80 other

Surfshark - 29 positions now, many engineering roles

Google - Field Sales Representative, Enterprise, Google Cloud

Oxylabs - Engineering Manager (new product) + everything else

VIALET - KAM, Engineers, more

Mediatech - product, tech, marketing - a lot of opportunities

FirstPromoter - SEO and Growth Marketer

CoinGate - BDR and more

Ergonix - Ecommerce Specialist

Optoman - KAM

isLucid - Developers

founder's guide

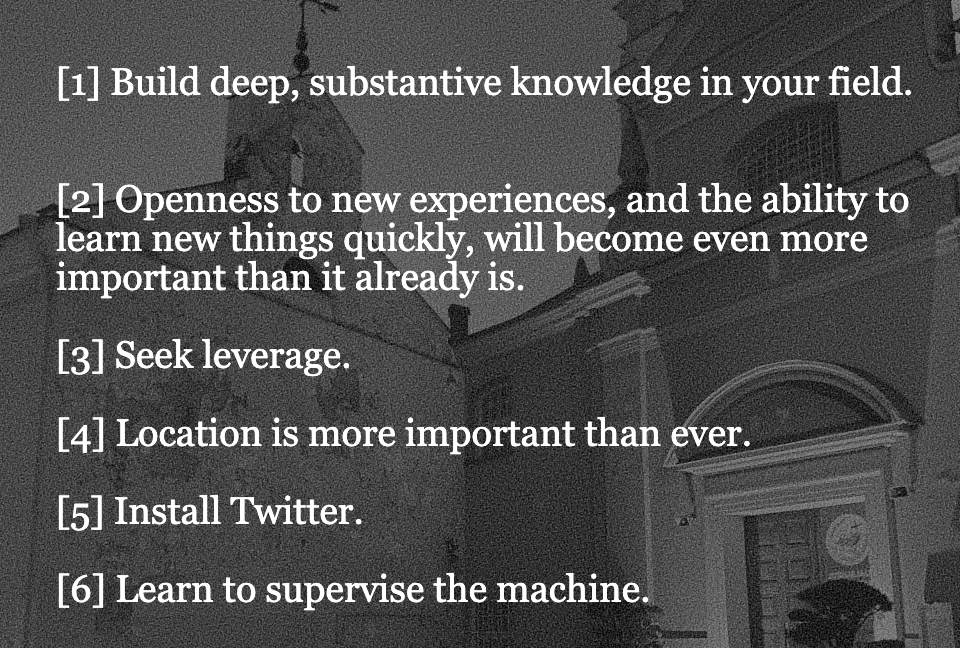

- Thin Desires Are Eating Your Life – think for 2026

- Yes, you are allowed not to send investor updates – given you exit for 3B+ later

- 10 promising side-project ideas

- VC value add: how Creandum cleaned cap table for Trade Republic (now 12B valuation)

- New VCs in/for the Baltics, 2025 – fresh capital looking for startups.

- New Year's letter to a young person

further insights

- Key rebrands that happened 2025, like "gambling –> prediction markets"

- Is it time to remove laptops from classrooms?

- 21 Lithuanian Founders, building in the US

Member discussion